Projects of JCM Income Fund II, LLC:

(early in the investment period)

Precision Roll Solutions |

|

|

Two properties located in Richmond, Virginia, both next to the airport, totaling 180,000 square feet on a 15-year lease. Both properties have Triple Net Leases. |

|

|

|

|

American Plastics |

|

A Greenville, South Carolina 168,000 square foot property with a 20-year Triple Net Lease. |

|

Projects of NVCapital Advisors, LLC:

NVEmblem |

|

A 245-unit garden apartment project in Newark, Delaware, adjacent to Christiana Mall. This development project was a joint venture with Leon N. Weiner & Associates ("LNWA"). Construction commenced in 2015 and was completed in 2017 at a cost of $41,000,000. It was sold in February 2020 to New York Life at a price of $60,000,000 |

|

NVFrederick |

|

The Frederick Bottling Plant, located in Frederick, Maryland, is an 86-unit apartment project with 8,000 square feet of commercial space in a historic building. This development project is a joint venture with Brick Lane, among others. Construction commenced in 2018 and was completed in February 2020 at a cost of $24 Million. As of December 2020, the project is 90% leased with the highest rents in Frederick. The project won the Delta Associates® award for the "Best Washington/Baltimore Low-Rise Apartment Community" in the Washington D.C. area |

|

NVCane Bay |

|

A 300-unit garden apartment project under development in the Cane Bay PUD in North Charleston, South Carolina. It is a joint venture with Monday Properties, which closed in 2019. Initial occupancy is anticipated First Quarter, 2021. |

|

Projects of NVCommercial Real Estate Fund I, LP:

Parker 15 |

|

This project's development began in 2014, as a Joint Venture with Bozzuto, with the NVCommercial Real Estate Fund I providing a participating Note for this 96-unit proposed condominium. The project's development cost was approximately $41 Million. Upon completion, in November 2016, the market was so strong for apartments, it was sold unleased, upon completion, at a purchase price of $53.6 Million, to an institutional investor which leased it as an apartment building. |

|

460 New York Avenue |

|

The Fund was in a joint venture to develop and sell a 63-unit residential condominium building with Bozzuto, a large regional apartment and home developer. The site is at the corner of New York Avenue and L Street NW in Washington, D.C., across the street from the CityVista Safeway and three blocks from both the Convention Center and Verizon Center Metro Stations. Upon completion, all residential units were successfully sold in 2015. |

|

The Pond Building |

|

The Fund provided a participating mortgage with a First Deed of Trust on an existing 48,036 square foot, 4-story office building in Reston, Virgina. 40% of the building was under contract at the time of purchase. $2 Million of capital improvements were made to upgrade the common areas of the building. There was little condominium supply in Reston, but strong demand from financial services and small IT/Tech companies. The remaining sales occurred in 2016. |

|

Dominion Heights |

|

Dominion Heights is a 66-unit residential condominium with 8,000 square feet of ground level retail located at the corner of Lee Highway and Monroe Street in Arlington, Virginia. This stalled condominium development was re-capitalized in 2011. It was successfully developed, in a joint venture with The Christopher Companies, and sold in 2013 |

|

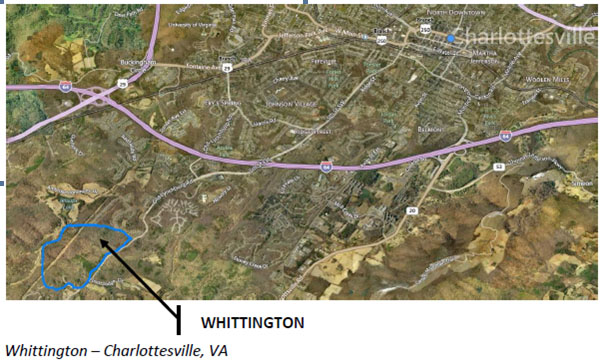

Whittington |

|

The Whittington parcel consists of 183 acres, entitled for 94 single family, one-acre lots in Charlottesville, Virginia. The property was acquired through the purchase of a First Deed of Trust Note and a subsequent foreclosure. This property was sold to a large regional homebuilder in 2013-2014. |

|

Rambler Manassas |

|

|

Rambler Manassas is a 43,200 square foot warehouse in the desirable Balls Ford industrial district in Manassas, Virginia. The property was purchased out of a bankruptcy proceeding, in 2012, and significant capital improvements and deferred maintenance were completed. The building was then re-leased to two tenants and, subsequently, sold to an investor in 2014 |

|

|

|

|

|

Rambler - Exterior |

Rambler - Interior |

Century |

|

The Century project is a joint venture with the Trammell Crow Company which owns 55 acres of land in Germantown, Maryland, currently entitled for up to 2.4 million square feet of mixed-use development. The site has 1,000 linear feet of frontage, along I-270, and is anticipated to have a future Corridor Cities Transitway stop. All individual development sites have been successfully sold. |

|

Pontiac Cascades |

|

|

The Pontiac Cascades investment was an acquired First Deed of Trust Note on 20 acres of age-restricted, multi-family land located in Loudoun County, Virginia. The Note was re-structured, extending the term for three years at an appropriate interest rate, plus participation, with the Borrower. Because of non-performance by the Borrower, a friendly foreclosure occurred and the property was successfully sold in 2018 |

|